straight life policy cash value

Corn Flour Pancakes Video Stuffed Peppers Design Canning. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit.

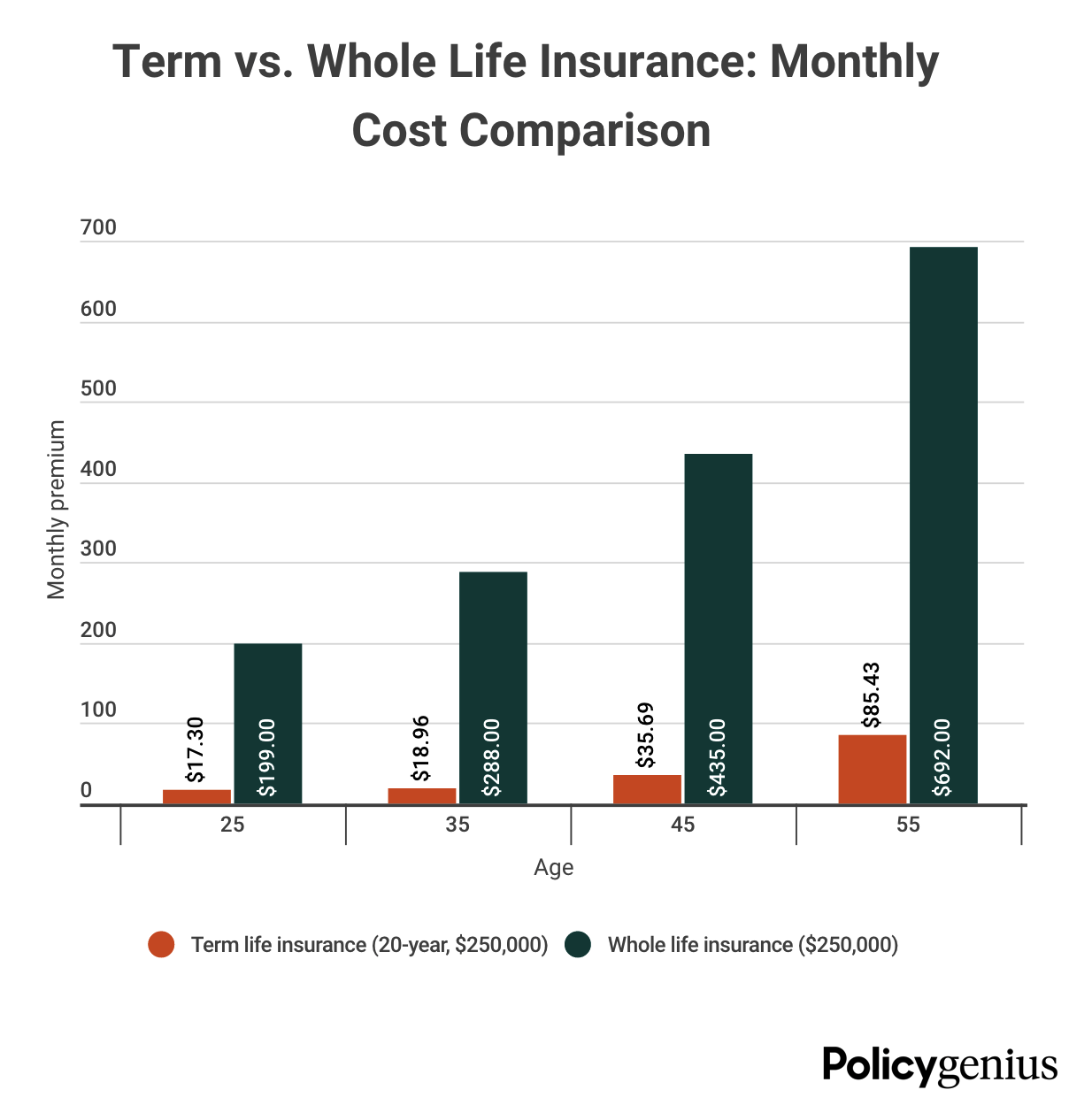

Term Life Vs Whole Life Insurance Understanding The Difference

You will be paying 40 your entire life.

. For instance if the face value of your whole life policy is 200000 and the cash value that has accumulated is valued at 20000 when you pass away the beneficiaries of your policy will receive the 200000 face value of your policy. B Its premium steadily decreases over time in response to its growing cash. The premium for a straight life policy is fixed and does not increase with age.

Web Straight life policy develops cash value Friday June 10 2022 Edit. You may be able to borrow against the cash value but any amount that you havent repaid when you die reduces the death benefit. It covers your life for a chosen period of time during which only the death of the insured will pay out any benefit.

The cash value is an interest-earning account inside of your straight life insurance policy. Rather than being seized as a collection measure on defaulted loans the cash value in your straight life policy can be leveraged to repay any creditors you owe. Pros and cons of a.

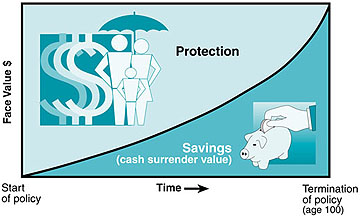

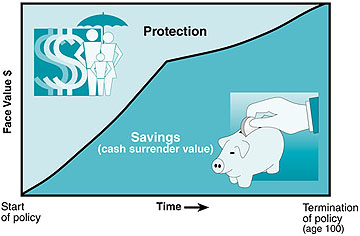

Learn the benefits of straight life insurance for individuals families and business. Also known as whole life insurance a straight life policy has a cash value account that grows in size as you contribute premiums to the plan. With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax deferred in a cash value account.

You may be able to borrow against the cash value but any amount that you havent repaid when you die reduces the death benefit. It usually develops cash value by the end of the third policy yearC. Different Policies Accumulate Cash Value in Different Ways Whole life policies provide guaranteed cash value accounts that grow according to a formula the insurance company.

What elements are guaranteed in a straight life policy. A straight life policy is not good if you need short-term coverage. 5-Year Term 6580 per year 10-Year Term 7030 per year Straight Life.

At this point one can use the cash account for many different things like. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. The policys current cash value of 3500 is the amount built over time by the accumulation of 30 of the premiums.

Current cash value of 3500. Like all annuities a straight life annuity provides a guaranteed income stream until the death of the annuity owner. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

A straight life policy has a level premiumit wont change over the life of your policy. This account will grow according to a guaranteed rate over the course of the policy length. Straight Life policies charge a level annual premium throughout the insureds lifetime and provide a level guaranteed death.

With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax deferred in a cash value account. The face value of the policy. A straight life insurance policy can also build.

Plr He May 21 2022 Edit. For instance you have a 150000 straight life insurance policy which you are supposed to pay 40 a month. The 20000 that remains will be collected by the insurance company.

A life insurance policys cash value is distinct from the death benefit. Like all annuities a straight life annuity provides a guaranteed income stream until the death of the annuity owner. Another asset of a straight life policy is a cash value account.

The rate of return will typically be large enough that when you turn 100 the cash value account will equal the value of the death benefit. See how a straight life policy compares to term or universal life. The cash account will have a guaranteed interest rate and will grow throughout the life of the policy.

Universal life policies accumulate cash value based on current interest rates. The cash value return rate at some point will be equal to the death benefit. A portion of the premium you pay for a straight life policy is added to the account each month.

A straight life insurance policy often known as whole life insurance has a cash value account that increases in size as you pay premiums into the plan. Variable life policies invest funds in. It usually develops cash value by the end of the third policy yearC.

In most states the cash value in your policy is protected from garnishments and seizure that might otherwise be incurred from legal judgements. A straight life insurance policy provides lifelong coverage at a consistent premium rate. The cash value is basically an investment account inside of your straight life insurance policy.

When you annuitize your annuity on a. Another asset of a straight life policy is a cash value account. Straight life insurance is a type of permanent life insurance that includes a cash value account that grows over the policys life.

We show you how to get the most out of your life settlement. The Advantage of Cash Value. Cash-value life insurance also known as permanent life insurance includes a death benefit in addition to cash value accumulation.

While variable life whole life and universal life insurance all have built-in cash value term life does not.

Term Life Vs Whole Life Insurance Policygenius

The 7 Types Of Life Insurance Policies What S The Best One For You

What Is A Straight Life Policy Bankrate

The 7 Types Of Life Insurance Policies What S The Best One For You

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

What Is Straight Life Insurance Valuepenguin

Life Insurance Purposes And Basic Policies Mu Extension

Life Insurance Purposes And Basic Policies Mu Extension

What Is A Straight Life Policy Bankrate

What Is Cash Value Life Insurance Smartasset Com

:max_bytes(150000):strip_icc()/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

Best Whole Life Insurance Companies Of 2022

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

.png)

Which Type Of Life Insurance Policy Generates Immediate Cash Value Private Advisory Vancouver Bc

What Is A Straight Life Policy Bankrate

The 7 Types Of Life Insurance Policies What S The Best One For You

Life Insurance Purposes And Basic Policies Mu Extension

Annuity Payout Options Immediate Vs Deferred Annuities